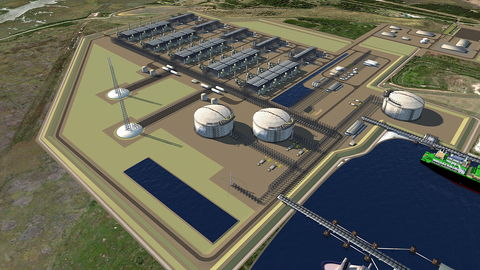

The LNG terminal in Stade is set to become a central hub for the import of liquefied natural gas to Germany. The Hanseatic Energy Hub will be ready to use from 2026 with a planned regasification capacity of around 12 billion cubic meters per annum (bcma). Up to 10 percent of Germany's gas requirements can be covered by this import infrastructure. The project will be realized in an existing industrial park and has been devised from the outset as a concept with future flexibility. Besides LNG, for instance, the terminal is also designed for low-carbon energy sources such as bio-LNG and synthetic methane in a first phase. With the growing global supply of climate-neutral energy sources, in a second step the hub is also set to be used to import hydrogen-based fuels, such as ammonia.

“We have expanded our LNG activities step by step in recent years. That's because liquefied natural gas plays a key role in the diversification of our fuels for energy generation: It opens up the possibility of new sources to secure Germany's gas supply in the transitional period of the new energy concept and builds a bridge to a green energy supply,” explains Georg Stamatelopoulos, Board Member for Sustainable Generation Infrastructure at EnBW. “That is why we specifically chose Stade as our import terminal. Technically, commercially and in terms of approval processes, the project is at a high stage of maturity. The zero-emissions concept and the short connection distance to the German gas transmission grid are also particularly relevant from our perspective.” As a zero-emissions terminal, the Stade LNG terminal does not release any carbon dioxide during operation because the heat required for the regasification of the liquefied natural gas is available as process waste heat from the nearby industrial and chemical park.

HEH plans to submit the approval documentation for the LNG terminal and port before Easter 2022. Until 8 April 2022, due to the changed market situation, interested parties will also have the opportunity to express their interest in long-term capacity bookings.

“With the LNG terminal in Stade, we are ready to play a major part in diversifying Germany's energy supply,” explains Johann Killinger, Managing Partner of the Hanseatic Energy Hub. “In EnBW, we not only have a strong anchor client from the start, but also another experienced partner who really understands both the global and local energy markets.”

About HEH

The Hanseatic Energy Hub (HEH) is a terminal for liquefied gases at the industrial site in Stade, Germany. The independent hub diversifies German industry's long-term import needs for affordable energy. In a first development phase, a zero-emission terminal is to be commissioned at end of 2026 at the earliest, with infrastructure also approved for bio-LNG and SNG. The planned regasification capacity is 12 billion m³/a and a feed-in capacity of 21.7 GW. With the development of new carbon-neutral energy sources, the hub will also facilitate the import of hydrogen-based energy carriers. HEH shareholders are the Buss Group from Hamburg, the gas infrastructure operator Fluxys and Partners Group.